Bajaj Finance Ltd. (BFL), one of India’s leading non-banking financial companies (NBFCs), announced its Q1 FY25 results recently. With a consistent track record of stellar performance, the Q1 2025 numbers once again highlight the company’s strength, digital transformation, and growth potential. In this post, we provide a detailed and SEO-friendly analysis of Bajaj Finance’s quarterly results, focusing on key financial metrics, segment-wise performance, management commentary, and outlook for the rest of the fiscal year.

Key Highlights of Bajaj Finance Q1 2025 Results

| Metric | Q1 FY25 | Q1 FY24 (YoY Growth) |

|---|---|---|

| Net Profit | ₹4,250 crore | ₹3,320 crore (28% growth) |

| Net Interest Income (NII) | ₹7,520 crore | ₹6,060 crore (24% growth) |

| Gross NPA | 0.92% | 1.10% |

| AUM (Assets Under Mgmt) | ₹3.15 lakh crore | ₹2.52 lakh crore |

| New Loans Booked | 9.7 million | 8.3 million |

| Customer Base | 83.5 million | 72.6 million |

Financial Performance Overview

Net Profit & NII Growth

Bajaj Finance delivered a net profit of ₹4,250 crore in Q1 FY25, a strong YoY growth of 28%. The company also posted a Net Interest Income of ₹7,520 crore, up 24% from the same quarter last year. This growth was driven by a healthy increase in its lending book and a strong uptick in customer acquisition.

Loan Book Expansion

The Assets Under Management (AUM) rose to ₹3.15 lakh crore, a robust 25% YoY growth. This reflects the company’s growing dominance across various lending segments including consumer, SME, commercial, and rural finance.

Asset Quality

One of the key takeaways from the Q1 results is the improvement in asset quality. The Gross NPA stood at 0.92%, down from 1.10% a year ago, signaling prudent credit risk management and better borrower performance.

Segment-Wise Performance

- Consumer B2C Lending

- Strong growth in personal loans, digital EMIs, and credit card sourcing.

- Digital origination platforms contributed over 60% of new loan bookings.

- SME Lending

- Surge in demand from Tier-2 and Tier-3 cities.

- Focus on working capital financing and digital lending.

- Rural Lending

- AUM from rural business rose by 18% YoY.

- Expanding footprint into underbanked villages.

- Deposits

- Deposits book grew 21% YoY, reaching ₹80,000 crore.

- Retail investor interest continues to grow due to competitive FD rates.

Digital Transformation

Bajaj Finance’s investments in AI, automation, and data analytics are beginning to pay dividends. The company recently launched:

- Digital Wallet Integration

- Paperless Loan Approvals in Under 5 Minutes

- AI-Powered Credit Scoring Model

Over 78% of new customers in Q1 were acquired through digital channels. The company’s app ecosystem also recorded a 2.1x jump in monthly active users YoY.

Management Commentary

Rajeev Jain, MD of Bajaj Finance, stated:

Q1 FY25 has set the tone for a solid year. Our digital-first approach, diversified loan book, and robust underwriting practices have helped us deliver consistent growth. We remain confident of achieving our guidance targets for FY25.

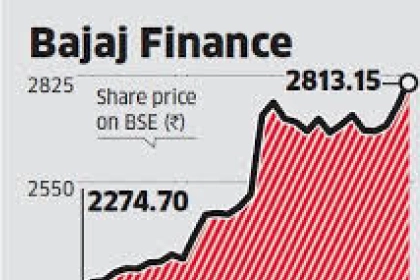

Bajaj Finance Share Price Reaction

Following the Q1 results announcement, the Bajaj Finance share price saw a 3.5% uptick in intraday trading, reflecting positive investor sentiment. Analysts have also upgraded the stock:

- Motilal Oswal: BUY, Target Price: Rs. 7,800

- HDFC Securities: BUY, Target Price: Rs. 7,650

- Jefferies: OUTPERFORM, Target: Rs. 7,900

Outlook for FY25

Bajaj Finance is expected to maintain a CAGR of 20-25% in loan book growth. With increased focus on digital transformation, cost optimization, and rural expansion, the company is poised for continued performance. Areas to watch in coming quarters:

- Inflation & RBI Rate Policy

- Regulatory Changes in NBFC Sector

- Customer Acquisition Costs

Final Thoughts

Bajaj Finance’s Q1 FY25 results reinforce its reputation as one of the most consistent and well-managed NBFCs in India. With strong fundamentals, improving asset quality, and an ever-growing digital ecosystem, the company is well-positioned to capitalize on India’s credit growth story.

Whether you’re a retail investor or an institutional player, Bajaj Finance shares deserve a spot on your watchlist in 2025.